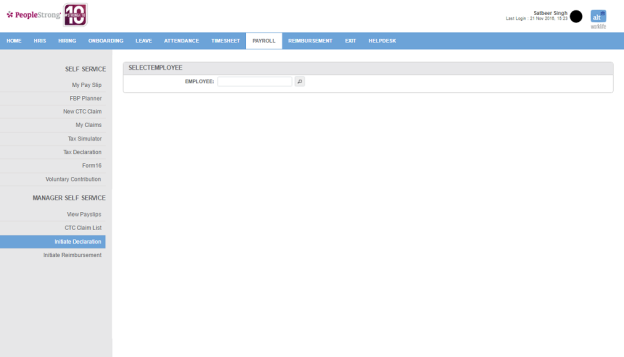

On Initiate Declaration page, you can declare investments and submit tax declaration on behalf of employees.

How to initiate tax declaration?

1. Click Search Icon. Following pop up will open.

2. Select Employee Code. Following page will be displayed.

| Chapter VIA - Section 80D to 80U/ Chapter VIA - Section 80C (Maximum of Rs. 1,50,000)/ Income From Other Sources | |

| Declared Amount | amount declared for a particular section. |

| Actual Amount | actual amount for a particular section. |

| Approved Amount | approved amount for a particular section. |

| Approver Remarks | remarks from approver. |

| House Rent Details | |

| From Date | start date of house rent declared. |

| To Date | end date of house rent declared. |

| City | list of cities. You can choose one. |

| Landlord Name | name of landlord. |

| Address | address of landlord. |

| Landlord PAN No. | PAN of landlord. Or click PAN Not Available link to upload document in case PAN no. of landlord is not available. |

| Declared Amount | rent amount declared per month. |

| Actual Amount | actual rent amount per month. |

| Approved Amount | approved rent amount per month. |

| Document | click Attach link to upload rent receipts. |

| Approver Remarks | remarks from approver. |

3. Enter the required information.

4. Click Submit button. Tax Declaration task will move to next stage.

Note: Depending on declaration frequency, tax declaration task will move to Tax Declaration/Proof Verification/Proof Verified stage. Go to How to approve tax declaration? on Approval page.