On Tax Declaration page, you can declare your investments and submit tax declaration.

How to do tax declaration?

| Chapter VIA - Section 80D to 80U/ Chapter VIA - Section 80C (Maximum of Rs. 1,50,000)/ House Rent Details/ Income From Other Sources | |

| Declared Amount | declared amount for a particular section. |

| Actual Amount | actual amount for a particular section. |

| Document | click Attach to upload the document, if required. |

1. Enter the required information.

2. Click section name under Chapter VIA - 80D to 80U and Income from Other Sources, if required. Following pop up will open.

| Holder Name | holder's name on whose behalf tax rebate has been taken. |

| Date | date of medical treatment done. |

| Amount | amount spent on medical treatment. |

| Attach File | click  icon to attach medical bill. icon to attach medical bill. |

| Remarks | remarks from employee. |

| Attach File Name | name of the file attached. |

3. Enter the required information.

4. Click Save button.

5. Click section name under Chapter VIA - 80C (Maximum of Rs. 1,50,000), if required. Following pop up will open.

| Property Address | address of property. |

| Date | date of buying the property. |

| Jointly Owned | can be checked or unchecked. Indicates whether the property is jointly owned or not. |

| Repayment Housing Loan Amount | housing loan amount to be repaid. |

| Repayment Housing Loan Attach File | click  icon to attach to attach loan details. icon to attach to attach loan details. |

| Repayment Housing Loan Remarks | remarks from employee regarding repayment of housing loan. |

6. Enter the required information.

7. Click Save button.

8. Click section name, Income on Housing Loan (Letout) under Income from Other Sources, if required. Following pop up will open.

| Property Address | address of property. |

| Gross Annual Value | gross annual value of the property. |

| Municipal Tax Paid | municipal tax paid. |

| Interest paid on housing loan of this property | Interest amount paid on housing loan of this property. |

9. Enter the required information.

10. Click Ok button. Following page will be displayed.

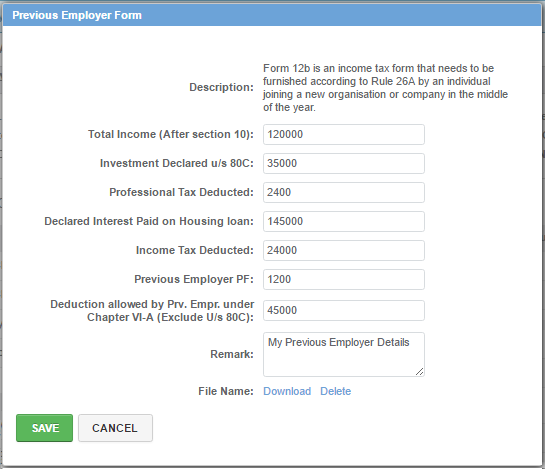

11. Click Previous Employer Form link. Following pop up will open.

| Description | description about the form. |

| Total Income (After section 10) | total income of employee from previous employer. |

| Investment Declared u/s 80C | investment declaration of employee under section 80C with previous employer. |

| Professional Tax Deducted | professional tax deducted from employee's income by previous employer. |

| Declared Income Paid on Housing loan | declared income paid by employee on housing loan with previous employer. |

| Income Tax Deducted | income tax deducted from employee by previous employer. |

| Previous Employer PF | PF amount deducted from employee by previous employer. |

| Deduction allowed by Prev. Empr. under Chapter VI-A (Exclude U/s 80C) | deductions allowed by previous employer under chapter VI-A excluding u/s 80C. |

| Remark | remarks from the employee. |

| File Name | Click Choose + button to upload tax declaration details of employee with previous employer. |

12. Enter the required details.

13. Click Save button.

Note: Previous Employer Form link will be visible to new joiners only.

14. Select Declaration checkbox.

15. Click Submit button. Tax Declaration task will move to Proof Verification stage.

16. Go to How to approve tax declaration? on CTC Claim List page.